The 7 Biggest Craigslist Scams

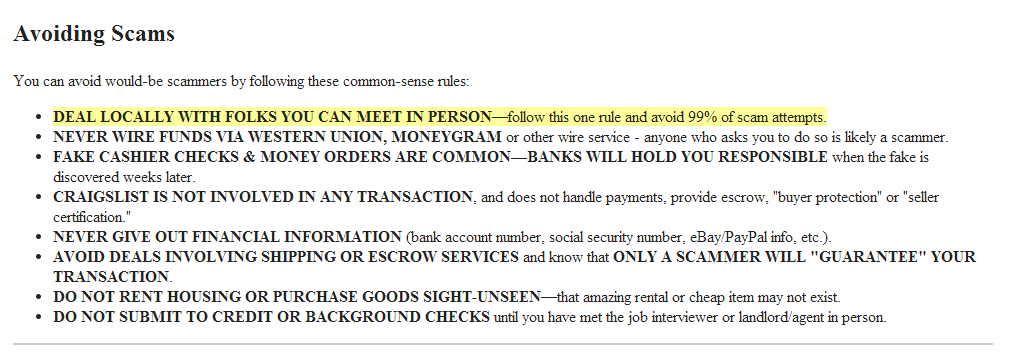

Online shopping is a great experience for internet users. Websites such as Amazon, Ebay and Craiglist allow customers to compare and search from a large selection of products all at the click of a button. But as with all retail Caveat Emptor (buyer be aware) we should also add sellers as scammers target anyone. Many retail scams have found their way onto the internet. Community pages like Craigslist and Gumtree in Australia are susceptible to fraud as buyers and sellers are not verified. See Craigslists top tips for avoiding scams below. We also detail some common scams after forewarned is forearmed.

Source: http://www.craigslist.org/about/scams

Free Furniture

The free furniturescam might work out well for you but not for the owner. In a famous incident a man in Oregon basically lost all his furniture (including a horse) after an ad was placed on Craigslist. The ad informed everyone that he was relocating and that all his belongings were free for the taking. He arrived home to be greeted by close to 30 people rummaging through his goods. After the incident the owner could not even relax on his porch swing as someone had already taken it! He managed to claim some goods back but the majority of people had already come and gone. It was a nasty scam as the scammer made no personal profit from the situation except for the enjoyment of seeing someone’s house ramsacked.

Cheap Rental Homes

High rental prices are a major problem for consumers as it is usually their largest expense every month. Scammers are well aware of this. One of the most common scams involves renting an apartment or house. The scammer will list pictures of the property based on another actual listing at a much lower price. The scammer will pretend to be the owner, but will ask interested parties for an application or deposit fee to hold the rental. Users can tell the ad is fake because they typically do not ask for social security numbers or personal information just the money.

Cell Phone Trickery

This scam combines the old with the new utilising phone bills and the internet. It starts off with an email expressing interest in a product or good you are selling. The ‘buyer’ however is very busy and would like you to leave your details on a website so they can get back to you. Unfortunately the website starts to bill your cellphone $9.95 a month. So the seller doesn’t make a sale but it actually costs them money. Even sellers need to be aware on the internet. Frustratingly you will not have the ability to cancel this anonymous service and will be required to terminate your credit card.

Used Cars For Less

The biggest purchase in someone’s life after a house is a car. Craigslist is a good place to find used cars in your local area but it also attracts the attention of scammers. Scammers will offer prices well below the normal price to attract the attention of a large amount of people. Tricks to look out for? Be wary of car prices well below market prices listed on valuation sites like Kelley Blue Book especially listings that have been posted from a person based in another country. Sellers from another country cannot be prosecuted locally if something goes wrong. Also be cautious when the seller mentions wire payments. Money transfer services such as Western Union are untraceable.

One of the benefits of using community sites is that they are local so there should be no need for you to deal with someone based in another country. Transact locally and personally and you should be able to keep away from 99% of scams.

Give-away from the Troops

This is a horrible scam using the good reputation of the armed forces to convince you to part with your cash. This scam involves ‘soldiers’ getting rid of large ticket items such as TV’s at a fraction of their market price before deploying overseas. As always if it’s too good to be true it most likely is.

Phishing for e-Bay

This is one of the more sophisticated scams using both Craigslist’s and eBay to take consumers money. The scam starts off with ads on Craigslist sending the buyer a link to a site that looks like eBay but captures the buyers login details and password. The scammer has many options they can sell fake goods with the new login or use it to login into Paypal (people usually use similar passwords) to transfer out money. Its like a Ponzi scheme that keeps growing, it is not just one scam but two into one. It is a tricky scam as eBay should be more secure over Craigslist as it is not accountable for any business mishaps. The best customers can do is to use sites that have verified sellers with companies that will stand by customers if the seller has done the wrong thing.

Student Roommates

This scam is known an advance fee fraud. It’s a little trickier in that a scammer will feign interest in a room sending a cheque as a deposit. Before it has the opportunity to bounce the scammer asks for an amount refunded back as they need to pay for their flight usually leaving the roommate out of pocket of a couple of thousand dollars. Once again this scam involves someone outside of the country and uses a site (in this case Craigslist) that doesn’t verify users as a medium for fraud.

Top 10 Scams Targeting Seniors

A lof of senior scams involve health care fraud due to the large amount seniors spend every year. It has been found that the US spends more on health care than 12 other industrialised countries yet it does not provide superior care for the price spent. According to the Commonwealth Fund the US spent nearly $8,000 per person in 2008 while the more mature and ageing Japan spent only 1/3 of this cost. There are a lot of inefficiencies within the US system but arguably some of this extra cost is due to fraud.

Health Care/Medicare/Health Insurance Fraud

Medicare is a national social insurance program that guarantees acess to health insurance for every US citizen over the age of 65. On average Medicare will cover 48% of the costs for users. Scammers are taking advantage of these payments getting older citizens to give out their personal details to provide services and bill Medicare.

The FBI estimates that health care fraud costs American tax payers $80 billion a year.

Because of the popularity of health care frauds, studies prove that 10 cents out of every dollar goes to paying deceptive health care claims. Not helping the matter is congressional legislation requiring that reasonable claims be paid in just 30 days making such payments amenable to fraud. More than 30 states have laws on timely claim payments.

Counterfeit Prescription Drugs

Consumers have many choices in buying prescription drugs buyers are no longer confined to just the local drugstore or chemist. The internet offers many choices but also risk as the amount of counterfeit drugs available has increased. In this case buyers need to be even more aware of the products. If you know the size, shape you may be able to identify counterfeits. Some counterfeit drugs may contain different ingredients and instead of helping may inflict even more harm.

The World Health Organization (WHO) has found counterfeit drugs make up almost 60% of the overall drug supply in some well developed countries where regulation is less strict. The majority of issues involved products without active ingredients, incorrect quantities of ingredients and wrong ingredients. To be safe consumers should only buy from safe reputable sources ie verified sellers. In this case you can check with the National Association of Boards of Pharmacy.

Funeral and Cemetery Scams

It is a horrible place to conduct a scam but scammers have been known to take advantage of such an emotional event. Most individuals would rather not think about their funeral or for their loved ones but being prepared is key. The standard funeral can cost up to $10,000. Some funeral directors have been known to upsell expensive caskets taking advantage of the vulnerability of the situation when much cheaper options such as cremation are available.

Fraudulent Anti-Aging Products

Ageing gracefully is the retirement plan for many. Seniors looking for the fountain of youth has become big business attracting scammers to the large and growing market for anti-aging products. Some of the most common fake products imitate botox.

The distributors of a range of deceptive anti-aging goods usually count on individuals who are searching for related treatments and medicines to slow down the aging process. The National Council on Aging (NCOA) has information users can check for details on false anti-aging products and solutions.

Questions to ask include where is the proof? If someone makes a claim ask for scientific evidence that backs it up and that the study was conducted independently. Remember celebrity endorsements don’t count and watch out for secret formulas! The Better Business Bureau has a great site where consumers can search if claims have been filed against certain products and manufacturers.

Telemarketing

Seniors still love to use the phone making twice as many purchases over a call than the average. Scammers take advantage of these statistics offering “free” products to individuals for which they are charged. They also try to sell counterfeit drugs and fraudulent anti-ageing products. Just remember to pay after the services are delivered not in advance.

Internet Fraud

The Internet is an easy way for scammers to access a lot of people cheaply. A website, spam electronic mail, online-messages, can gain access to a large audience very quickly. Many internet scams are old scams reinvigorated for today. As always make enquiries of the company involved and when making payments use your credit card as if you can prove a fraud you might be able to get your money back.

Investment Schemes

Seniors are popular targets for investment schemes as they are typically retired with large amounts of savings to manage. Investment scams come in many forms with the cold call investment tip to ‘guaranteed’ income plans and pyramid schemes like Bernie Madoff’s.

Your first protection is to know who is calling never deal with people you cannot verify and if tempted make sure you seek independent financial advice before proceeding.

Homeowner/Reverse Mortgage Scams

Reverse mortgages allow homeowners to convert equity in their home into cash by re-borrowing against the house and withdrawing money. These loans are a little different in that the loan does not have to repaid until the homeowner moves out, sells the house or dies. Scammers are taking advantage of this financial innovation by targeting senior citizens pressuring them to take out reverse mortgages when they are not needed and charging inappropriate fees.

Sweepstakes and Lottery Scams

Free money always gets people’s attention. This scam is popular with seniors as many do enter lotteries and sweepstakes. They aim to get your personal details to prove that you are the approved winner and your personal bank account details so the award can be transferred to you. Scammers will often ask for upfront payments to cover costs, administration taxes, bank charges or courier fees. These Lottery scams will often employ the names of lawful overseas lotteries adding legitimacy to their claims.

A common trick is for the ‘lottery’ to mail you a fake cheque. While the cheque is being cleared they will request fees or taxes on the price leaving you out of pocket when the cheque bounces. If you get such an email or text message please do not respond back and do not mail any money or any details to the scammers.

The Grandparent Scam

This is one of the sneakier scams where the scammer pretends to be a family member. How do they fake it, they typically start with Hi, do you know who this is? When they guess the name the scammers run with it and gain the callers trust. Scammers often target nursing homes pretending to be a grandson in need of money because they have been arrested overseas or in some financial difficulty but do not want to tell the parents. To protect yourself from this scam make sure you verify with the parents as once you wire money you can’t get it back.

Financial Scams

Most scams lead people to think that they have the opportunity to achieve a lot (for some in terms of financial remuneration or an ideal relationship) in return for little up-front cost. As a common rule, if it is too good to be true, it probably is.

If you have suffered from an Internet scam, please inform your local authorities and send them all your correspondence including if it came from a particular website. When you have become the victim of a scam, it is best to stop all communications with the con artist. It is exceptional for victims to recuperate lost money by themselves. If you feel threatened in anyway, you should report it right away to the local police.

Internet-dating

Seniors are major targets of dating scams because they typically have assets and maybe lonely. Scammers can be very convincing going to great lengths to build a relationship with you before attempting to persuade you to send them money. It is easy to pretend that you are someone you are not on the internet. Once a connection is made the correspondent requests the victim to send over money or to help them for expenses such as hospital fees or money for flights.

Work Permits

This is another famous Nigerian scam targeting those looking for work. They typically offer the intended victim a large salary for a few months work in Nigeria but first the employee must pay up front certain fees related to permits and visas. They use the guilt trip on applicants stating that they can be only sure of the applicant’s willingness to work once the fee is paid.

Inheritance Scam

Inheritance scams begin with a call out of the blue to inform you that you are entitled to a large inheritance form a wealthy relative overseas. Some scammers will give out a fake name of your supposed family member, others may find real names based on research and information available publicly on family websites to make the scam seem more realistic.

The scammer will pretend to be a banker, lawyer, or other foreign officer will inform you that the money may be difficult to access because of government and tax restrictions in the country. To gain access you will be asked for your bank account details and even to pay a series of fees to help release the money trapped overseas. As with many frauds they typically ask for money orders or wire transfers as once they are sent they are difficult to recover.

Overpayment and Money Laundering Scam

Advance-fee scams are some of the most popular online frauds for sellers on the internet. The most common involve cheques that are overpaid, the scammer will make an excuse and ask you to refund the excess amount. Hoping that you will do this before you find out the cheque has bounced. The sellers end up losing the item that they have shipped and also the excess money.

Follow

Follow

Be First to Comment